by Robyn Bolton | Jan 25, 2026 | AI, Leadership, Leading Through Uncertainty

Spain, 1896

At the tender age of 14, Pablo Ruiz Picasso painted a portrait of his Aunt Pepa a work of brilliant academic realism that would go on to be hailed as “without a doubt one of the greatest in the whole history of Spanish painting.”

In 1901, he abandoned his mastery of realism, painting only in shades blue and blue-green.

There’s debate over why Picasso’s Blue Period began. Some argue that it’s a reflection of the poverty and desperation he experienced as a starving artist in Paris. Others claim it was a response to the suicide of his friend, Carles Casagemas. But Bill Gurley, a longtime venture capitalist, has a different theory.

Picasso abandoned realism because of the Kodak Brownie.

Introduced on February 1, 1900, the Kodak Brownie made photography widely available, fulfilling George Eastman’s promise that “you press the button, we do the rest.”

An ocean away, Gurley argues, Picasso’s “move toward abstraction wasn’t a rejection of skill; it was a recognition that realism had stopped being the frontier….So Picasso moved on, not because realism was wrong, but because it was finished.”

Washington DC, 2004

Three years before Drive took the world by storm, Daniel Pink published his third book, A Whole New Mind: Why Right-Brainers Will Rule the Future.

In it, he argues that a combination of technological advancements, higher standards of living, and access to cheaper labor are pushing us from a world that values left brain skills like linear thought, analysis, and optimization towards one that requires right brain skills like artistry, empathy, and big picture thinking.

As a result, those who succeed in the future will be able to think like designers, tell stories with context and emotional impact, and combine disparate pieces into a whole greater than the sum of its parts. Leaders will need to be empathetic, able to create “a pathway to more intense creativity and inspiration,” and guide others in the pursuit of meaning and significance.

California, 2026

Barry O’Reilly, author of Unlearn, published his monthly blog post, “Six Counterintuitive Trends to Think about for 2026,” in which he outlines what he believes will be the human reactions to a world in which AI is everywhere.

Leadership, he asserts, will cease to be measured by the resources we control (and how well we control them to extract maximum value) but by judgment. Specifically, a leader’s ability to:

- Ask better questions

- Frame decisions clearly

- Hold ambiguity without freezing

- Know when not to use AI

The Price of Safety vs the Promise of Greatness

Picasso walked away from a thriving and lucrative market where he was an emerging star to suffer the poverty, uncertainty, and desperation of finding what was next. It would take more than a decade for him to find international acclaim. He would spend the rest of his life as the most famous and financially successful artist in the world.

Are you willing to take that same risk?

You can cling to the safety of what you know, the markets, industries, business models, structures, incentives that have always worked. You can continue to demand immediate efficiency, obedience, and profit while experimenting with new tech and playing with creative ideas.

Or you can start to build what’s next. You don’t have to abandon what works, just as Picasso didn’t abandon paint. But you do have to start using your resources in new ways. You must build the characteristics and capabilities that Daniel Pink outlines. You must become the “counterintuitive” leader that embraces ambiguity, role models critical thinking, and rewards creativity and risk-taking.

Do you have the courage to be counterintuitive?

Are you willing to embrace your inner Picasso?

by Robyn Bolton | Dec 10, 2025 | Customer Centricity, Innovation, Leading Through Uncertainty

In times of great uncertainty, we seek safety. But what does “safety” look like?

What we say: Safety = Data

We tend to believe that we are rational beings and, as a result, we rely on data to make decisions.

Great! We’ve got lots of data from lots of uncertain periods. HBR examined 4,700 public companies during three global recessions (1980, 1990, and 2000). They found that the companies that the companies that emerged “outperforming rivals in their industry by at least 10% in terms of sales and profits growth” had one thing in common: They aggressively made cuts to improve operational efficiency and ruthlessly invested in marketing, R&D, and building new assets to better serve customers have the highest probability of emerging as markets leaders post-recession.

This research was backed up in 2020 in a McKinsey study that found that “Organizations that maintained their innovation focus through the 2009 financial crisis, for example, emerged stronger, outperforming the market average by more than 30 percent and continuing to deliver accelerated growth over the subsequent three to five years.”

What we do: Safety = Hoarding

The reality is that we are human beings and, as a result, make decisions based on how we feel and the use data to justify those decisions.

How else do you explain that despite the data, only 9% of companies took the balanced approach recommended in the HBR study and, ten years later, only 25% of the companies studied by McKinsey stated that “capturing new growth” was a top priority coming out of the COVID-19 pandemic.

Uncertainty is scary so, as individuals and as organizations, we scramble to secure scarce resources, cut anything that feels extraneous, and shift or focus to survival.

What now? And, not Or.

What was true in 2010 is still true today and new research from Bain offers practical advice for how leaders can follow both their hearts and their heads.

Implement systems to protect you from yourself. Bain studied Fast Company’s 50 Most Innovative Companies and found that 79% use two different operating models for innovation to combat executives’ natural risk aversion. The first, for sustaining innovation uses traditional stage-gate models, seeks input from experts and existing customers, and is evaluated on ROI-driven metrics.

The second, for breakthrough innovations, is designed to embrace and manage uncertainty by learning from new customers and emerging trends, working with speed and agility, engaging non-traditional collaborators, and evaluating projects based on their long-term potential and strategic option value.

Don’t outspend. Out-allocate. Supporting the two-system approach, nearly half of the companies studied send less on R&D than their peers overall and spend it differently: 39% of their R&D budgets to sustaining innovations and 61% to expanding into new categories or business models.

Use AI to accelerate, not create. Companies integrating AI into innovation processes have seen design-to-launch timelines shrink by 20% or more. The key word there is “integrate,” not outsource. They use AI for data and trend analysis, rapid prototyping, and automating repetitive tasks. But they still rely on humans for original thinking, intuition-based decisions, and genuine customer empathy.

Prioritize humans above all else. Even though all the information in the world is at our fingerprints, humans remain unknowable, unpredictable, and wonderfully weird. That’s why successful companies use AI to enhance, not replace, direct engagement with customers. They use synthetic personas as a rehearsal space for brainstorming, designing research, and concept testing. But they also know there is no replacement (yet) for human-to-human interaction, especially when creating new offerings and business models.

In times of great uncertainty, we seek safety. But safety doesn’t guarantee certainty. Nothing does. So, the safest thing we can do is learn from the past, prepare (not plan) for the future, make the best decisions possible based on what we know and feel today, and stay open to changing them tomorrow.

by Robyn Bolton | Dec 2, 2025 | AI

“It just popped up one day. Who knows how long they worked on it or how many of millions were spent. They told us to think of it as ChatGPT but trained on everything our company has ever done so we can ask it anything and get an answer immediately.”

The words my client was using to describe her company’s new AI Chatbot made it sound like a miracle. Her tone said something else completely.

“It sounds helpful,” I offered. “Have you tried it?”

“I’m not training my replacement! And I’m not going to train my R&D, Supply Chain, Customer Insights, or Finance colleagues’ replacements either. And I’m not alone. I don’t think anyone’s using it because the company just announced they’re tracking usage and, if we don’t use it daily, that will be reflected in our performance reviews.”

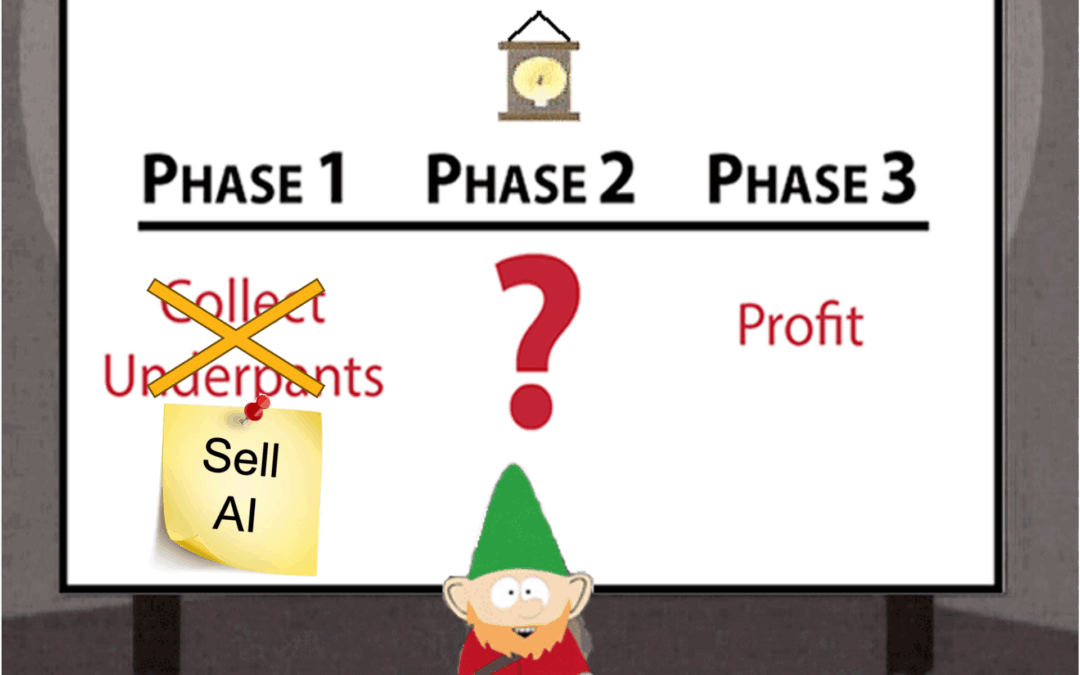

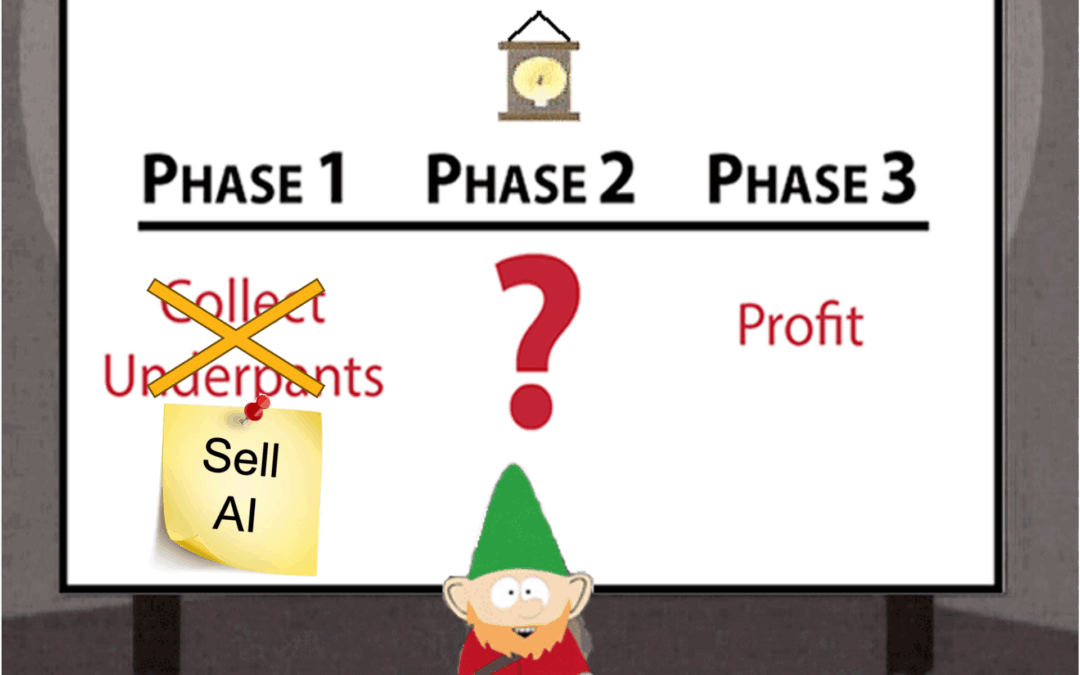

All I could do was sigh. The Underpants Gnomes have struck again.

Who are the Underpants Gnomes?

The Underpants Gnomes are the stars of a 1998 South Park episode described by media critic Paul Cantor as, “the most fully developed defense of capitalism ever produced.”

Claiming to be business experts, the Underpants Gnomes sneak into South Park residents’ homes every night and steal their underpants. When confronted by the boy in their underground lair, the Gnomes explain their business plan:

- Collect underpants

- ?

- Profit

It was meant as satire.

Some took it as a an abbreviated MBA.

How to Spot the Underpants AI Gnomes

As the AI hype grows, fueling executive FOMO (Fear of Missing Out), the Underpants Gnomes, cleverly disguised as experts, entrepreneurs and consultants, saw their opportunity.

- Sell AI

- ?

- Profit

While they’ve pivoted their business focus, they haven’t improved their operations so the Underpants AI Gnomes as still easy to spot:

- Investment without Intention: Is your company investing in AI because it’s “essential to future-proofing the business?” That sounds good but if your company can’t explain the future it’s proofing itself against and how AI builds a moat or a life preserver in that future, it’s a sign that the Gnomes are in the building.

- Switches, not Solutions: If your company thinks that AI adoption is as “easy as turning on Copilot” or “installing a custom GPT chatbot, the Gnomes are gaining traction. AI is a tool and you need to teach people how to use tools, build processes to support the change, and demonstrate the benefit.

- Activity without Achievement: When MIT published research indicating that 95% of corporate Gen AI pilots were failing, it was a sign of just how deeply the Gnomes have infiltrated companies. Experiments are essential at the start of any new venture but only useful if they generate replicable and scalable learning.

How to defend against the AI Gnomes

Odds are the gnomes are already in your company. But fear not, you can still turn “Phase 2:?” into something that actually leads to “Phase 3: Profit.”

- Start with the end in mind: Be specific about the outcome you are trying to achieve. The answer should be agnostic of AI and tied to business goals.

- Design with people at the center: Achieving your desired outcomes requires rethinking and redesigning existing processes. Strategic creativity like that requires combining people, processes, and technology to achieve and embed.

- Develop with discipline: Just because you can (run a pilot, sign up for a free trial), doesn’t mean you should. Small-scale experiments require the same degree of discipline as multi-million-dollar digital transformations. So, if you can’t articulate what you need to learn and how it contributes to the bigger goal, move on.

AI, in all its forms, is here to stay. But the same doesn’t have to be true for the AI Gnomes.

Have you spotted the Gnomes in your company?

by Robyn Bolton | Nov 11, 2025 | Leadership, Leading Through Uncertainty

The business press has a new obsession with courageous leadership.

Harvard Business Review dedicated their September cover story to it. Nordic Business Forum built an entire 2024 conference around it. BetterUp, McKinsey, and dozens of thought leaders and influencers can’t stop talking about it.

Here’s what they’re all telling you: If you’re playing it safe, stuck in analysis paralysis, not innovating fast enough, or not making bold moves, then you are the problem because you lack courage.

Here’s what they’re not telling you: You don’t have a courage problem. You have a systems problem.

The Real Story Behind “Courage Gaps”

The VP was anything but cowardly. She had a track record of bold moves and wasn’t afraid of hard conversations. The CEO wanted to transform the company by moving from a product-only focus to one offering holistic solutions that combined hardware, software, and services. This VP was the obvious choice.

Her team came to her with a ideas that would reposition the company for long-term growth. She loved it. They tested the ideas. Customers loved them. But not a single one ever launched.

It wasn’t because the VP or the CEO lacked courage. It was because the board measured success in annual improvements, the CEO’s compensation structure rewarded short-term performance, and the VP required sign-off from six different stakeholders who were evaluated on risk mitigation. At every level, the system was designed to kill bold ideas. And it worked.

This is the inconvenient truth the courage press ignores.

That success doesn’t just require leaders who are courageous, it requires organizational architecture that systematically rewards courage and manages risk.

What We’re Really Asking Leaders to Overcome

Consider what we’re actually asking leaders to be courageous against:

- Compensation structures tied to short-term metrics

- Risk management processes designed to say “no”

- Approval hierarchies where one skeptic can overrule ten enthusiasts

- Cultures where failed experiments end careers

The courage discourse lets broken systems off the hook.

It’s easier to sell “10 Ways to Build Leadership Courage” than to admit that organizational incentives, governance structures, and cultural norms are actively working against the bold moves we tell leaders to make.

What Actually Enables Courageous Leadership.

I’m not arguing that there isn’t a need for individual courage. There is.

But telling someone to “be braver” when their organizational architecture punishes bravery is like telling someone to swim faster in a pool filled with Jell-O.

If we want courage, we need to fix the things the systems that discourage it:

- Align incentives with the time horizon of the decisions you want made

- Create explicit permission structures for experimentation

- Build decision-making processes that don’t require unanimous consent

- Separate “learning investments” from “performance expectations” when measuring results

- Make the criteria for bold moves clear, not subject to whoever’s in the room

But doing this is a lot harder than buying books about courage.

The Bottom Line

When you fix the architecture, you don’t need to constantly remind people to be brave because the system enables. Individual courage becomes the expectation, not the exception.

The real question isn’t whether your leaders need courage.

It’s whether your organization has the architecture to let them use it.

If you can’t answer that question, that’s not a courage problem.

That’s a design problem.

And design is something that, as a leader, you can actually control.

by Robyn Bolton | Oct 28, 2025 | Leadership, Strategy

Last week, I shared that 74% of executives believe that their organizations will cease to exist in ten years. They believe that strategic transformation is required, but cite the obvious problem of organizational inertia and the easy scapegoat of people’s resistance to change.

Great. Now we know the problem. What’s the solution?

The Obvious: Put the Right People in Leadership Roles

Flipping through the report, the obvious answers (especially from an executive search firm) were front and center:

- Build a top team with relevant experience, competencies, and diverse backgrounds

- Develop the team and don’t be afraid to make changes along the way

- Set a common purpose and clear objectives, then actively manage the team

The Easy: Do Your Job as a Leader

OK, these may not be easy but it’s not that hard, either:

- Relentlessly and clearly communicate the why behind the change

- Change one thing at a time

- Align incentives to desired outcomes and behaviors

- Be a role model

- Understand and manage culture (remember, it’s reflected in the worst behaviors you tolerate)

The Not-Obvious-or-Easy-But-Still-Make-or-Break: Deputize the Next Generation

Buried amongst the obvious and easy was a rarely discussed, let alone implemented, choice – actively engaging the next generation of leaders.

But this isn’t the usual “invite a bunch of Hi-Pos (high potentials) to preview and upcoming announcement or participate in a focus group to share their opinions” performance most companies engage in.

This is something much different.

Step 1: Align on WHY an “extended leadership team” of Next Gen talent is mission critical

The C-Suite doesn’t see what happens on the front lines. It doesn’t know or understand the details of what’s working and what’s not. Instead, it receives information filtered through dozens of layers, all worried about positioning things just right.

Building a Next Gen extended leadership team puts the day-to-day realities front and center. It brings together capabilities that the C-Suite team may lack and creates the space for people to point out what looks good on paper but will be disastrous in practice.

Instead, leaders must commit to the purpose and value of engaging the next generation, not merely as “sensing mechanisms” (though that’s important, too) but as colleagues with different and equally valuable experiences and insights.

Step 2: Pick WHO is on the team without using the org chart

High-potentials are high potential because they know how to succeed in the current state. But transformation isn’t about replicating the current state. It requires creating a new state. For that, you need new perspectives:

- Super connecters who have wide, diverse, and trusted relationships across the organization so they can tap into a range of perspectives and connect the dots that most can barely see

- Credible experts who are trusted for their knowledge and experience and are known to be genuinely supportive of the changes being made

- Influencers who can rally the troops at the beginning and keep them motivated throughout

Step 3: Give them a clear mandate (WHAT) but don’t dictate HOW to fulfill it

During times of great change, it’s normal to want to control everything possible, including a team of brilliant, creative, and committed leaders. Don’t involve them in the following steps and be open to being surprised by their approaches and insights:

- At the beginning, involve them in understanding and defining the problem and opportunity.

- Throughout, engage them as advisors and influencers in decision-making (

- During and after implementation, empower them to continue to educate and motivate others and to make adaptations in real-time when needed.

Co-creation is the key to survival

Transforming your organization to survive, even thrive, in the future is hard work. Why not increase your odds of success by inviting the people who will inherit what you create to be part of the transformation?