by Robyn Bolton | Jan 17, 2026 | AI, Leadership, Leading Through Uncertainty, Stories & Examples

You’ve clarified the vision and strategy. Laid out the priorities and simplified the message. Held town halls, answered questions, and addressed concerns. Yet the AI initiative is stalled in ‘pilot mode,’ your team is focused solely on this quarter’s numbers, and real change feels impossible. You’re starting to suspect this isn’t a “change management” problem.

You’re right. It’s not.

The Data You’re Not Seeing

You’ve been doing what the research tells you to do: communicate clearly and frequently, clarify decision rights, and reduce change overload. And these things worked. Until employees went from grappling with two to 10 planned change initiatives in a single year. As the number went up, willingness to support organization change crashed, falling from 74% of employees in 2016 to 43% in 2022.

But here’s what the research isn’t telling you: despite your organizational fixes, your people are terrified. 77% of workers fear they’ll lose their jobs to AI in the next year. 70% fear they’ll be exposed as incompetent. And 66% of consumers, the highest level in a decade, expect unemployment to continue to rise.

Why doesn’t the research focus on fear? Because it’s uncomfortable. Messy. It’s a people (Behavior) problem, not a process (Architecture) problem and, as a result, you can’t fix it with a new org chart or better meeting cadence.

The organizational fixes are necessary. They’re just not sufficient to give people the psychological reassurance, resilience, and tools required to navigate an environment in which change is exponential, existential, and constant.

What Actually Works

In 2014, Microsoft was toxic and employees were afraid. Stack ranking meant every conversation was a competition, every mistake was career-limiting, and every decision was a chance to lose status. The company was dying not from bad strategy, but from fear.

CEO Satya Nadella didn’t follow the old change management playbook. He did more:

First, he eliminated the structures that created fear, including the stack ranking system, the zero-sum performance reviews, the incentives that punished mistakes. These were Architecture fixes, and they mattered.

And he addressed the messy, uncomfortable emotions that drove Behavior and Culture. He role modeled the Behaviors required to make it psychologically safe to be wrong. He introduced the “growth mindset” not as a poster on the wall, but as explicit permission to not have all the answers. When he made a public gaffe about gender equality, he immediately emailed all 200,000 employees: “My answer was very bad.” No spin. No excuses. Just modeling the vulnerability that he expected from everyone.

Ten years later, Microsoft is worth $2.5 trillion. Employee engagement and morale are dramatically improved because Nadella addressed the structures that fed fear AND the fear itself.

What This Means for You

You don’t need to be Satya Nadella. But you do need to stop pretending fear doesn’t exist in your organization.

Name it early and often. Not just in the all-hands meeting, but in the team meetings and lunch-and-learns. Be honest, “Some roles will change with this AI implementation. Here’s what we know and don’t know.” Make the implicit explicit.

Eliminate the structures that create fear. If your performance system pits people against each other, change it. If people get punished for taking smart risks, stop. If people ask questions or make suggestions, listen and act.

Be vulnerable. Share what you’re uncertain about. Admit when you don’t know. Show that it’s safe to be learning. Demonstrate that learning is better than (pretending to) know.

The stakes aren’t abstract: That AI pilot stuck in testing. The strategic initiative that gets compliance but not commitment. The team so focused on surviving today they can’t prepare for tomorrow. These aren’t communication failures. They’re misaligned ABCs that allow fear to masquerade as pragmatism.

And the masquerade only stops when you align align the ABCs all at once. Because fixing Architecture without changing your Behavior simply gives fear a new place to hide.

by Robyn Bolton | Nov 19, 2025 | Innovation, Stories & Examples

I can’t believe that I’m writing this. Honestly, I can’t believe I’m even thinking this. I’m an open-minded person, but I truly never thought that anything would ever change my mind on this topic. And yet, I must confess that I’ve come to the conclusion that…

(deep breath)

Innovation Theater is important.

(Sorry, needed a minute to recover. It’s one thing to think something. It’s another to see it in writing.)

Why We All Hate(d) Innovation Theater.

The term “Innovation Theater” was coined by Steve Blank in a 2019 HBR article to describe innovation activities like hackathons, shark tanks, and workshops that “shape and build culture, but they don’t win wars, and they rarely deliver shippable/deployable product.”

The name stuck because it gave the Innovation Industrial Complex a perfect scapegoat. Innovation efforts weren’t producing results because companies were turning real strategy into theater—events that could be delegated and scheduled instead of the courage, commitment, and willingness to change that actual innovation requires.

And in many cases, this criticism was warranted.

But in our rush to dismiss Innovation Theater, we missed something important.

What I (Almost) Missed.

Recently, I visited a company’s Innovation Center, curious to see what ten years of innovation investments and two floors in a downtown high-rise had produced.

The answer was a framework to think more deeply about equity and inclusion. My immediate reaction was rage. A decade of investments for this? Millions of dollars spent on the very definition of Innovation Theater? And they’re bragging about it?!?

Once the rage subsided, something remained. Something that I couldn’t shake. An inkling that I had missed something. That inkling became the realization that I was wrong.

Over the past five years, the framework had been used in carefully curated workshops to help teams across the organization see things they had previously overlooked, understand topics that were sensitive or taboo, and envision solutions that no one their heavily regulated industry had even considered.

Not every workshop resulted in action. But over time, something shifted.

Seasons. Not Shows.

Repetition created a shared language. Multiple touchpoints built permission. Small success stories accumulated to make risk feel manageable. The workshops didn’t send off isolated sparks of innovation. They built the conditions were acting on new ideas became progressively safer and more normal.

And after several seasons, enduring value was created. The company now enjoys the highest retention rate of customers in its industry and has attracted more new customers than all its competitors combined. A decade of “Innovation Theater” delivered exactly what innovation is supposed to deliver: measurable competitive advantage and revenue growth.

Don’t Cancel Your Next Innovation Event.

The problem isn’t Innovation Theater itself. It’s how we practice it.

A one-off hackathon? Theater. An annual workshop? Theater. But sustained investment over years, touching dozens of teams, building shared language and accumulated proof points? That’s a strategic bet on transformation that creates lasting competitive advantage.

The question isn’t whether Innovation Theater works. It’s whether you’re willing to commit to the season, not just the show. Are you prepared to invest consistently, measure differently, and wait for compounding effects that won’t show up in next quarter’s results?

Because when you commit to the season, not just the show, it’s the most strategic bet you can make.

by Robyn Bolton | Aug 4, 2025 | Leadership, Leading Through Uncertainty, Stories & Examples, Strategy

The best business advice can destroy your business. Especially when you follow it perfectly.

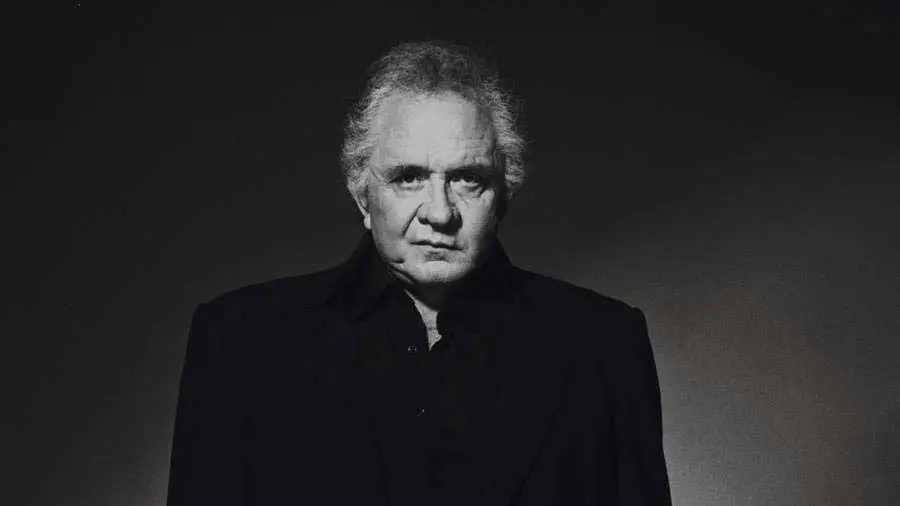

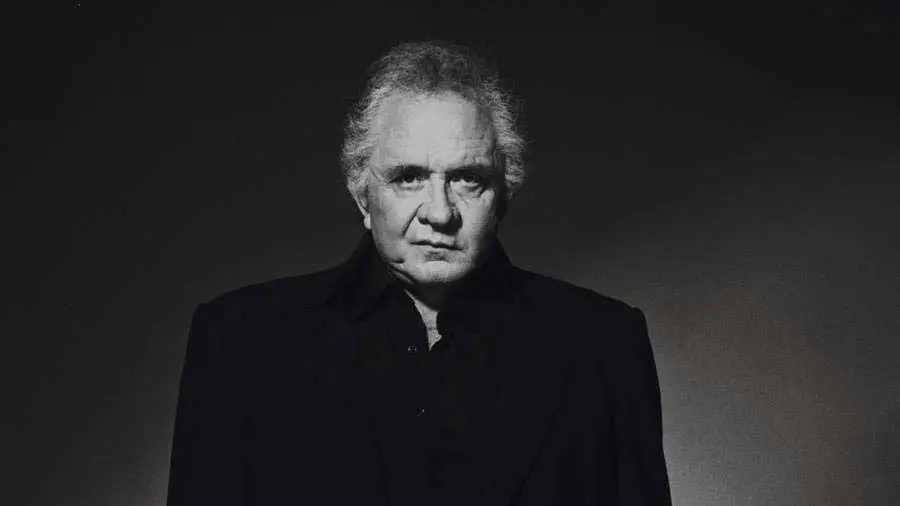

Just ask Johnny Cash.

After bursting onto the scene in the mid-1950s with “Folsom Prison Blues”, Cash enjoyed twenty years of tremendous success. By the 1970s, his authentic, minimalist approach had fallen out of favor.

Eager to sell records, he pivoted to songs backed by lush string arrangements, then to “country pop” to attract mainstream audiences and feed the relentless appetite of 900 radio stations programming country pop full-time.

By late 1992, Johnny Cash’s career was roadkill. Country radio had stopped playing his records, and Columbia Records, his home for 25 years, had shown him the door. At 60, he was marooned in faded casinos, playing to crowds preferring slot machines to songs.

Then he took the stage at Madison Square Garden for Bob Dylan’s 30th anniversary concert.

In the audience sat Rick Rubin, co-founder of Def Jam Recordings and uber producer behind Public Enemy, Run-DMC, and Slayer, amongst others. He watched in awe as Cash performed, seeing not a relic but raw power diluted by smart decisions.

The Stare-Down that Saved a Career

Four months later, Rubin attended Cash’s concert at The Rhythm Café in Santa Anna, California. According to Cash’s son, “When they sat down at the table, they said: ‘Hello.’ But then my dad and Rick just sat there and stared at each other for about two minutes without saying anything, as if they were sizing each other up.”

Eventually, Cash broke the silence, “What’re you gonna do with me that nobody else has done to sell records for me?”

What happened next resurrected his career.

Rubin didn’t promise record sales. He promised something more valuable: creative control and a return to Cash’s roots.

Ten years later, Cash had a Grammy, his first gold record in thirty years, and CMA Single of the Year for his cover of Nine Inch Nails’ “Hurt,” and millions in record sales.

When Smart Decisions Become Fatal

Executives do exactly what Cash did. You respond to market signals. You pivot your offering when customer preferences shift and invest in emerging technologies.

All logical. All defensible to your board. All potentially fatal.

Because you risk losing what made you unique and valuable. Just as Cash lost his minimalist authenticity and became a casualty of his effort to stay relevant, your business risks losing sight of its purpose and unique value proposition.

Three Beliefs at the Core of a Comeback

So how do you avoid Cash’s initial mistake while replicating his comeback? The difference lies in three beliefs that determine whether you’ll have the creative courage to double down on what makes you valuable instead of diluting it.

- Creative confidence: The belief we can think and act creatively in this moment.

- Perceived value of creativity: Our perceived value of thinking and acting in new ways.

- Creative risk-taking: The willingness to take the risks necessary for active change.

Cash wanted to sell records, and he:

- Believed that he was capable of creativity and change.

- Saw the financial and reputational value of change

- Was willing to partner with a producer who refused to guarantee record sales but promised creative control and a return to his roots.

Your Answers Determine Your Outcome

Like Cash, what you, your team, and your organization believe determines how you respond to change:

- Do I/we believe we can creatively solve this specific challenge we’re facing right now?

- Is finding a genuinely new approach to this situation worth the effort versus sticking with proven methods?

- Am I/we willing to accept the risks of pursuing a creative solution to our current challenge?”

Where there are “no’s,” there is resistance, even refusal, to change. Acknowledge it. Address it. Do the hard work of turning the No into a Yes because it’s the only way change will happen.

The Comeback Question

Cash proved that authentic change—not frantic pivoting—resurrects careers and disrupts industries. His partnership with Rubin succeeded because he answered “yes” to all three creative beliefs when it mattered most. Where are your “no’s” blocking your comeback?

by Robyn Bolton | Jul 23, 2025 | Leadership, Leading Through Uncertainty, Stories & Examples

What does a lightning strike in a Spanish forest have to do with your next leadership meeting? More than you think.

On June 14, 2014, lightning struck a forest on Spain’s northeast coast, only 60 miles from Barcelona. Within hours, flames 16 to 33 feet high raced out of control toward populated areas, threatening 27,000 acres of forest, an area larger than the city of Boston.

Everything – data, instincts, decades of firefighting doctrine – prioritized saving the entire forest and protecting the coastal towns.

Instead, the fire commanders chose to deliberately let 2,057 acres, roughly the size of Manhattan’s Central Park, burn.

The result? They saved the other 25,000 acres (an area the size of San Francisco), protected the coastal communities, and created a natural firebreak that would protect the region for decades. By accepting some losses, they prevented catastrophic ones.

The Fear Trap That’s Strangling Your Business

The Tivissa fire’s triumph happened because firefighters found the courage to escape what researchers call the “fear trap” – the tendency to focus exclusively on defending against known, measurable risks.

Despite research proving that defending against predictable, measurable risks through defensive strategies consistently fails in uncertain and dynamic scenarios, firefighter “best practices” continue to advocate this approach.

Sound familiar? It should. Most executives today are trapped in exactly this pattern.

We’re in the fire right now. Financial markets are yo-yoing, AI threatens to disrupt everything, and consumer behaviors are shifting.

Most executives are falling into the Fear Trap by doubling down on protecting their existing business and pouring resources into defending against predictable risks. Yet the real threats, the ones you can’t measure or model, continue to pound the business.

While you’re protecting last quarter’s wins, tomorrow’s disruption is spreading unchecked.

Four Principles for Creative Decision-Making Under Fire

The decision to cede certain areas wasn’t hasty but based on four principles enabling leaders in any situation to successfully navigate uncertainty.

PRINCIPLE 1: A Predictable Situation is a Safe Situation. Stop trying to control the uncontrollable. Standard procedures work in predictable situations but fail in unprecedented challenges.

Put it in Practice: Instead of creating endless contingency plans, build flexibility and agility into operations and decision-making.

PRINCIPLE 2: Build Credibility Through Realistic Expectations. Reducing uncertainty requires realism about what can be achieved. Fire commanders mapped out precisely which areas around Tivissa would burn and which would be saved, then communicated these hard truths and the considered trade-offs to officials and communities before implementing their strategy, building trust and preventing panic as the selected areas burned.

Put it in practice: Stop promising to protect everything and set realistic expectations about what you can control. Then communicate priorities, expectations, and trade-offs frequently, transparently, and clearly with all key stakeholders.

PRINCIPLE 3: Include the future in your definition of success: Traditional firefighting protects immediate assets at risk. The Tivissa firefighters expanded this to include future resilience, recognizing that saving everything today could jeopardize the region tomorrow.

Put it in practice: Be transparent about how you define the Common Good in your organization, then reinforce it by making hard choices about where to compete and where to retreat. The goal isn’t to avoid all losses – it’s to maximize overall organizational health.

PRINCIPLE 4: Use uncertainty to build for tomorrow: Firefighters didn’t just accept that 2,057 acres would burn – they strategically chose which acres to let burn to create maximum future advantage, protecting the region for generations.

Put it in practice: Evaluate every response to uncertainty on whether it better positions you for future challenges. Leverage the disruption to build capabilities, market positions, and organizational structures that strengthen you for future uncertainty.

Your Next Move

When the wind shifted and the fire exploded, firefighters had to choose between defending everything (and likely losing it all) or accepting strategic losses to ensure overall wins.

You’re facing the same choice right now.

Like the firefighters, your breakthrough might come not from fighting harder against uncertainty, but from learning to work with it strategically.

What are you willing to let burn to save what matters most?

by Robyn Bolton | Jun 25, 2025 | Leadership, Stories & Examples, Strategy

Convinced that Strategic Foresight shows you a path through uncertainty? Great! Just don’t rush off, hire futurists, run some workshops, and start churning out glossy reports.

Activity is not achievement.

Learning from those who have achieved, however, is an excellent first activity. Following are the stories of two very different companies from different industries and eras that pursued Strategic Foresight differently yet succeeded because they tied foresight to the P&L.

Shell: From Laggard to Leader, One Decision at a Time

It’s hard to imagine Shell wasn’t always dominant, but back in the 1960s, it struggled to compete. Tired of being blindsided by competitors and external events, they sought an edge.

It took multiple attempts and more than 10 years to find it.

In 1959, Shell set up their Group Planning department, but its reliance on simple extrapolations of past trends to predict the future only perpetuated the status quo.

In 1965, Shell introduced the Unified Planning Machinery, a computerized forecasting tool to predict cash flow based on current results and forecasted changes in oil consumption. But this approach was abandoned because executives feared “that it would suppress discussion rather than encourage debate on differing perspectives.”

Then, in 1967, in a small 18th-floor office in London, a new approach to ongoing planning began. Unlike past attempts, the goal was not to predict the future. It was to “modify the mental model of decision-makers faced with an uncertain future.”

Within a few years, their success was obvious. Shell executives stopped treating scenarios as interesting intellectual exercises and started using them to stress-test actual capital allocation decisions.

This doesn’t mean they wholeheartedly embraced or even believed the scenarios. In fact, when scenarios suggested that oil prices could spike dramatically, most executives thought it was far-fetched. Yet Shell leadership used those scenarios to restructure their entire portfolio around different types of oil and to develop new capabilities.

The result? When the 1973 oil crisis hit and oil prices quadrupled from $2.90 to $11.65 per barrel, Shell was the only major oil company ready. While competitors scrambled and lost billions, Shell turned the crisis into “big profits.”

Disney: From Missed Growth Goals to Unprecedented Growth

In 2012, Walt Disney International’s (WDI) aggressive growth targets collided with a challenging global labor market, and traditional HR approaches weren’t cutting it.

Andy Bird, Chairman of Walt Disney International, emphasized the criticality of the situation when he said, “The actions we make today are going to make an impact 10 to 20 years down the road.”

So, faced with an unprecedented challenge, the team pursued an unprecedented solution: they built a Strategic Foresight capability.

WDI trained over 500 leaders across 45 countries, representing five percent of its workforce, in Strategic Foresight. More importantly, Disney integrated strategic foresight directly into their strategic planning and performance management processes, ensuring insights drove business decisions rather than gathering dust in reports.

For example, foresight teams identified that traditional media consumption was fracturing (remember, this was 2012) and that consumers wanted more control over when and how they consumed content. This insight directly shaped Disney+’s development.

The results speak volumes. While traditional media companies struggled with streaming disruption, Disney+ reached 100 million subscribers in just 16 months.

Two Paths. One Result.

Shell and Disney integrated Strategic Foresight differently – the former as a tool to make high-stakes individual decisions, the latter as an organizational capability to affect daily decisions and culture.

What they have in common is that they made tomorrow’s possibilities accountable to today’s decisions. They did this not by treating strategic foresight as prediction, but as preparation for competitive advantage.

Ready to turn these insights into action? Next week, we’ll dive into the tools in the Strategic Foresight toolbox and how you and your team can use them to develop strategic foresight that drives informed decisions.

by Robyn Bolton | Apr 1, 2025 | Leadership, Stories & Examples, Strategy

If you’re leading a legacy business through uncertainty, pay attention. When The Cut asked, “Can Simon & Schuster Become the A24 of Books?” I expected puff-piece PR. What I read was a quiet masterclass in business transformation—delivered in three deceptively casual quotes from Sean Manning, Simon & Schuster’s new CEO. He’s trying to transform a dinosaur into a disruptor and lays out a leadership playbook worth stealing.

Seventy-four percent of corporate transformations fail, according to BCG. So why should we believe this one might be different? Because every now and then, someone in a legacy industry goes beyond memorable soundbites and actually makes moves. Manning’s early actions—and the thinking behind them—hint that this is a transformation worth paying attention to.

“A lot of what the publishing industry does is just speaking to the converted.”

When Manning says this, he’s not just throwing shade—he’s naming a common and systemic failure. While publishing execs bemoan declining readership, they keep targeting the same demographic that’s been buying hardcovers for decades.

Sound familiar?

Every legacy industry does this. It’s easier—and more immediately profitable—to sell to those who already believe. The ROI is better. The risk is lower. And that’s precisely how disruption takes root.

As Clayton Christensen warned in The Innovator’s Dilemma, established players obsess over their best customers and ignore emerging ones—until it’s too late. They fear that reaching the unconverted dilutes focus or stretches resources. But that thinking is wrong. Even in a world of finite resources, you can’t afford to pick one or the other. Transformation, heck, even survival, requires both.

“We’re essentially an entertainment company with books at the center.”

Be still my heart. A CEO who defines his company by the Job(to be Done) it performs in people’s lives? Swoon.

This is another key to avoiding disruption – don’t define yourself by your product or industry. Define yourself by the value you create for customers.

Executives love repeating that “railroads went out of business because they thought their business was railroads.” But ask those same executives what business they’re in, and they’ll immediately box themselves into a list of products or industry classifications or some vague platitude about being in the “people business” that gets conveniently shelved when business gets bumpy.

When you define yourself by the Job you do for your customers, you quickly discover more growth opportunities you could pursue. New channels. New products. New partnerships. You’re out of the box —and ready to grow.

“The worry is that we can’t afford to fail. But if we don’t try to do something, we’re really screwed.”

It’s easy to calculate the cost of trying and failing. You have the literal receipts. It’s nearly impossible to calculate the cost of not trying. That’s why large organizations sit on the sidelines and let startups take the risks.

But there IS a cost to waiting. You see it in the market share lost to new entrants and the skyrocketing valuations of successful startups. The problem? That information comes too late to do anything about it.

Transformation isn’t just about ideas. It’s about choosing action over analysis. Or, as Manning put it, “Let’s try this and see what happens.”

Walking the Talk

Quotable leadership is cute. Transformation leadership is concrete. Manning’s doing more than talking—he’s breaking industry norms.

Less than six months into his tenure as CEO, he announced that Simon & Schuster would no longer require blurbs—those back-of-jacket endorsements that favor the well-connected. He greenlit a web series, Bookstore Blitz, and showed up at tapings. And he’s reframing what publishing can be, not just what it’s always been.

The journey from dinosaur to disruptor is long, messy, and uncertain. But less than a year into the job, Manning is walking in the right direction.

Are you?