Managing Uncertainty: 3 Steps from Stuck to Success

When a project is stuck and your team is trying to manage uncertainty, what do you hear most often:

- “We’re so afraid of making the wrong decision that we don’t make any decisions.”

- “We don’t have time to explore a bunch of stuff. We need to make decisions and go.”

- “The problem is so multi-faceted, and everything affects everything else that we don’t know where to start.”

I’ve heard all three this week, each spoken by teams leads who cared deeply about their projects and teams.

Differentiating between risk and uncertainty and accepting that uncertainty would never go away, just change focus helped relieve their overwhelm and self-doubt.

But without a way to resolve the fear, time-pressure, and complexity, the project would stay stuck with little change of progressing to success.

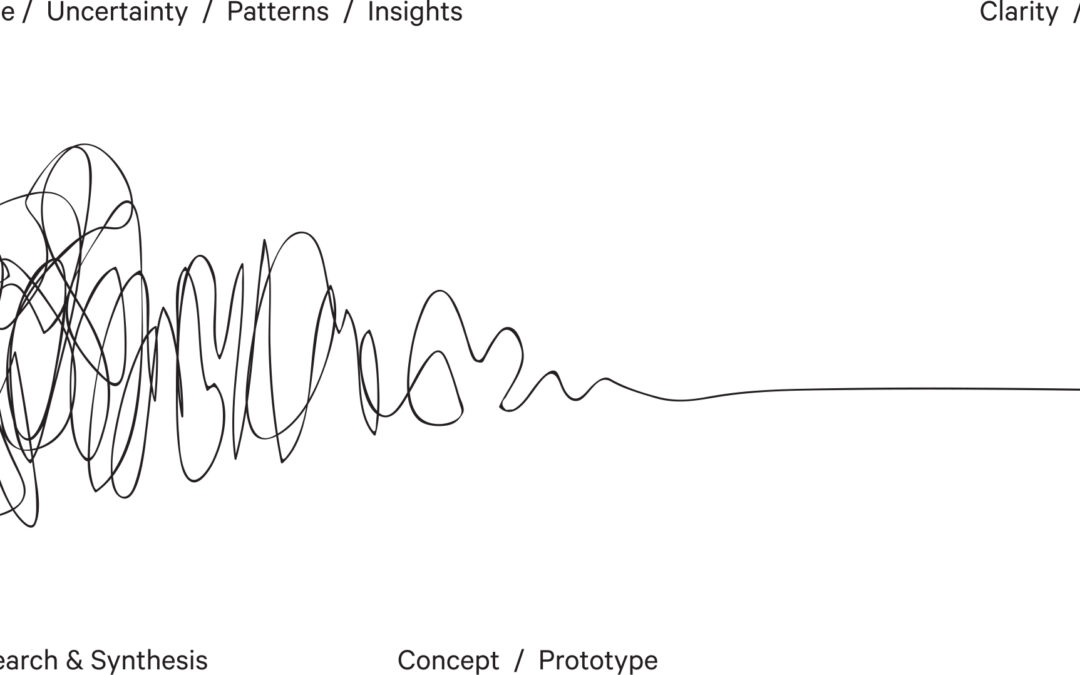

Turn uncertainty into an asset

It’s a truism in the field of innovation that you must fall in love with the problem, not the solution. Falling in love with the problem ensures that you remain focused on creating value and agnostic about the solution.

While this sounds great and logically makes sense, most struggle to do it. As a result, it takes incredible strength and leadership to wrestle with the problem long enough to find a solution.

Uncertainty requires the same strength and leadership because the only way out of it is through it. And, research shows, the process of getting through it, turns it into an asset.

3 Steps to turn uncertainty into an asset

Research in the music and pharmaceutical industries reveals that teams that embraced uncertainty engaged in three specific practices:

- Embrace It: Start by acknowledging the uncertainty and that things will change, go wrong, and maybe even fail. Then stay open to surprise and unpredictability, delving into the unknown “by being playful, explorative, and purposefully engaging in ventures with indeterminate outcome.”

- Fix It: Especially when dealing with Unknowable Uncertainty, which occurs when more info supports several different meanings rather than pointing to one conclusion, teams that succeed make provisional decisions to “fix” an uncertain dimension so they can move forward while also documenting the rationale for the fix, setting a date to revisit it, and criteria for changing it.

- Ignore It: It’s impossible to embrace every uncertainty at once and unwise to fix too many uncertainties at the same time. As a result, some uncertainties, you just need to ignore. Successful teams adopt “strategic ignorance” “not primarily for purposes of avoiding responsibility [but to] allow postponing decisions until better ideas emerge during the collaborative process.

This practice is iterative, often leading to new knowledge, re-examined fixes, and fresh uncertainties. It sounds overwhelming but the teams that are explicit and intentional about what they’re embracing, fixing, and ignoring are not only more likely to be successful, but they also tend to move faster.

Put it into practice

Let’s return to NatureComp, a pharmaceutical company developing natural treatments for heart disease.

Throughout the drug development process, they oscillated between addressing What, Who, How, and Where Uncertainties. They did that by changing whether they embraced, fixed, or ignored each type of uncertainty at a given point:

As you can see, they embraced only one type of uncertainty to ensure focus and rapid progress. To avoid the fear of making mistakes, they fixed uncertainties throughout the process and returned to them as more information came available, either changing or reaffirming the fix. Ignoring uncertainties helped relieve feelings of being overwhelmed because the team had a plan and timeframe for when they would shift from ignoring to embracing or fixing.

Uncertainty is dynamic. You need to be dynamic, too.

You’ll never eliminate uncertainty. It’s too dynamic to every fully resolve. But by dynamically embracing, fixing, and ignore it in all its dimensions, you can accelerate your path to success.